Pay Day! Where is My Money Going?

Author: Isaac Ehlers | Image: Isaac Ehlers

Author: Isaac Ehlers | Image: Isaac Ehlers

It is Friday, which also means PAY DAY, and everyone is waiting on their bank account to reflect that! However, sometimes what we are expecting is way less, why is that? Today I’ll explain where our money is going.

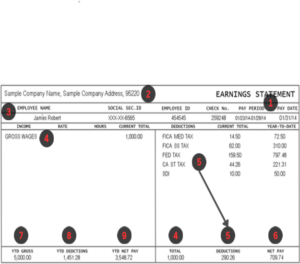

Let’s review our mock paystub!