For many students, borrowing in order to finance their college degree is necessary. College is an investment in your future. While student loans may be a necessary part of financing your degree, it’s important to borrow responsibly. This means only borrowing for what you need. Your debt burden upon graduation can be minimized if you track your loans every year, and only borrow for school-related expenses.

When borrowing for school, there are four questions you’ll need to consider:

- How much will I have to borrow?

- Review your current loan balance. Students can find their current loan balance by reviewing the “Loan Pmt Estimate” tab in their AccessPlus account or by logging into their account online on StudentAid.gov.

- Create a budget to help keep borrowing to a minimum. Only borrow what you need. Use our Expense Estimator tool to figure out what your costs will be this year, and what your financial aid covers.

- Annual federal loan amounts can be found at https://www.financialaid.iastate.edu/federal-loan-limits/

- Know before you Owe

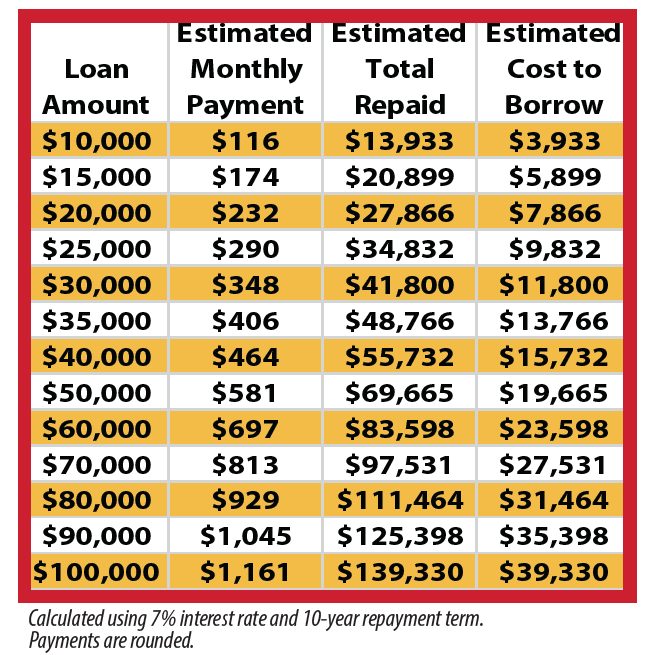

- What will be the monthly payment?

- You can also use the Loan Simulator provided by Federal Student Aid to estimate your loan payments.

- Can I afford it?

- Understand and be realistic about your earning potential after graduation. For example, if you are a Journalism major, and the entry-level, starting salary for journalists is $30,000, you should not be borrowing over that amount in student loans.

- List of Salaries Post Graduation

- Do I need to reduce or eliminate certain costs?

- Things to consider – housing costs, dining dollars, study abroad, new vs used texts, etc.

- Check out our Budgeting Resources for additional ways to save!

To find out how much you can afford to borrow, schedule a Financial Success appointment in Navigate Student app.

Private Loan Counseling

The Office of Student Financial Success, along with the Office of Student Financial Aid , requires all undergraduate private education loan borrowers to complete Private Loan Counseling (PLC) when borrowing for their first private loan at ISU. Private education loans will not apply in full to the student’s Ubill until they have completed Private Loan Counseling.

- For one term loans, the entire loan will be placed on hold.

- For fall/spring loans, the 2nd disbursement (Spring disbursement) will be placed on hold until after the student has completed their PLC requirement.

During the private loan counseling appointment, the student will review a financial plan to cover their costs at ISU, their estimated debt at graduation, a budget to ensure responsible loan borrowing, and discuss ideas to reduce your costs and increase grant, work, and scholarship opportunities in the future.

Private loan counseling appointments must be completed Monday-Friday between 8:00 am – 5:00 pm and usually take 15-20 minutes. To prepare for the appointment, please be prepared with the loan amount, loan interest rate, and the name of the lender.

Students needing to complete Private Loan Counseling will be notified weekly of this requirement until they have successfully completed their PLC.

Students can schedule their appointments using the Navigate Student app once notified to complete the requirement. Appointment times tend to fill up quickly during the weeks leading up to and starting a new term, so plan accordingly when applying for your first private education loan.