The first step to managing your money is creating a budget. Since budgeting allows you to create a spending plan for your money, it ensures that you will always have enough money for the things you need and the things that are important to you. Following a budget or spending plan will keep you out of debt and can also help you work your way out of debt.

Budgeting and Money Management

How to Create a Budget

- Create an estimated budget

- List where you think your money comes from.

- List where you think your money goes.

- This allows you to create a budget based off of how you perceive you spend your money.

- Track all expenditures

- Keep track of all your spending from rent, food, dining out, grabbing a soda, etc.

- Keep track of spending via cash, debit card, or credit card.

- This will allow you to see where your money is actually being spent.

- Compare

- Compare your estimated budget to your actual expenditures.

- Through this comparison, you will realize where you are spending your money and possible cutbacks to save.

- Create an expected budget

- Using the information from your comparison, you can create an expected budget.

- Remember to include one-time only expenses for the month like birthdays, holidays, insurance payments, etc.

- You can use your budget to keep your spending on track.

- Track, monitor, adjust, repeat

- Continue to track your spending and adjust your budget next month accordingly.

- Repeat

Budgeting Resources

- Use our Expenses Estimator to help create an educational budget. This tool will help you determine what is covered by your financial aid, and what you may have to come up with out of pocket. The estimator also helps determine if you will need an additional loan to pay your outstanding Ubill balance. Remember – books, athletic tickets, parking permits, etc. are not included in the calculation. It will only show the direct billable costs (ex: tuition, feed, room & board) that you must pay by August & January 20th.

- We have a template available to help you get started.

- The National Foundation for Credit Counseling is the nation’s largest nonprofit financial counseling organization. Find out about their services.

- The Federal Trade Commission provides helpful tools that help you create a budget, learn about credit, loans, managing debt and what you should do in the event of an identity scam. Learn more.

- Practical Money Skills helps make financial literacy easy for everyone. Check out their new interactive money guide for students.

Best Budgeting Apps

Download the best budget app to help you save money, budget for upcoming expenses, and avoid coming up shorthanded at the end of the month. Finding a good budget takes practice, but with these budgeting and money apps for iPhone and Android, you can keep your finances in check.

Saving Strategies

Savings are a key part in money management as they help to build in a level of security for the future. Savings help us pay for unexpected expense, and help us afford the things we want without going into debt.

Build an Emergency Fund

Experts say you should always have 3-6 months worth of your normal living expenses saved up in an emergency fund. This pool is set aside for emergency car repairs, medical expenses, or any other unexpected expense. In the event you lose your job, or you are between jobs, an emergency fund will be important so that you can still pay your bills and make your other monthly commitments without relying on credit cards or taking out additional loans.

For students, a good goal would be to have anywhere between $500 and $1,000 saved up in an emergency fund. This will help you cover that last minute textbook, or new set of brake pads when your old ones go out.

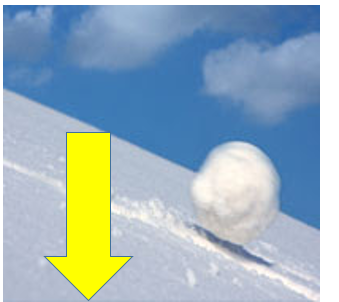

Consider “Snowballing” Your Savings

Snowball Savings

- $5 a week for a month

- $10 a week for a month

- $15 a week for a month

- $20 a week for a month

- At the end of the year, you have $600!